Crypto Quant Markets in Transition: Lessons from 2025 and Outlook for 2026

1. INTRODUCTION

Oxido Solutions is a crypto quant trading firm focused on institutional investors. Our strategies are used by allocators to diversify existing portfolios and to generate additional, systematic return streams within clearly defined risk parameters.

2025 marked our fifth consecutive year of live trading in the crypto quant space. It was a strong and productive year, but also one that clearly demonstrated how much the market has changed. Conditions shifted frequently, and strategies that worked well in earlier years often struggled to adapt.

Throughout the year, market behavior was influenced by several factors. Macroeconomic uncertainty remained high. Expectations around U.S. monetary policy changed multiple times. Political developments in the United States, including renewed trade policy tensions and the reintroduction of import tariffs under the Trump administration, added further uncertainty. At the same time, institutional participation continued to grow, and volatility events became more abrupt. One clear example was the sharp market dislocation in October 2025.

As a result, many quant strategies that had previously performed well stopped working. The gap widened between teams that were able to adjust to changing conditions and those that were not.

For Oxido Solutions, 2025 was a successful year. Our strategies held up well during choppy, sideways markets and were able to monetize strong trends and volatility expansions when conditions improved. This is exactly how our fully automated scalping strategies are designed to behave.

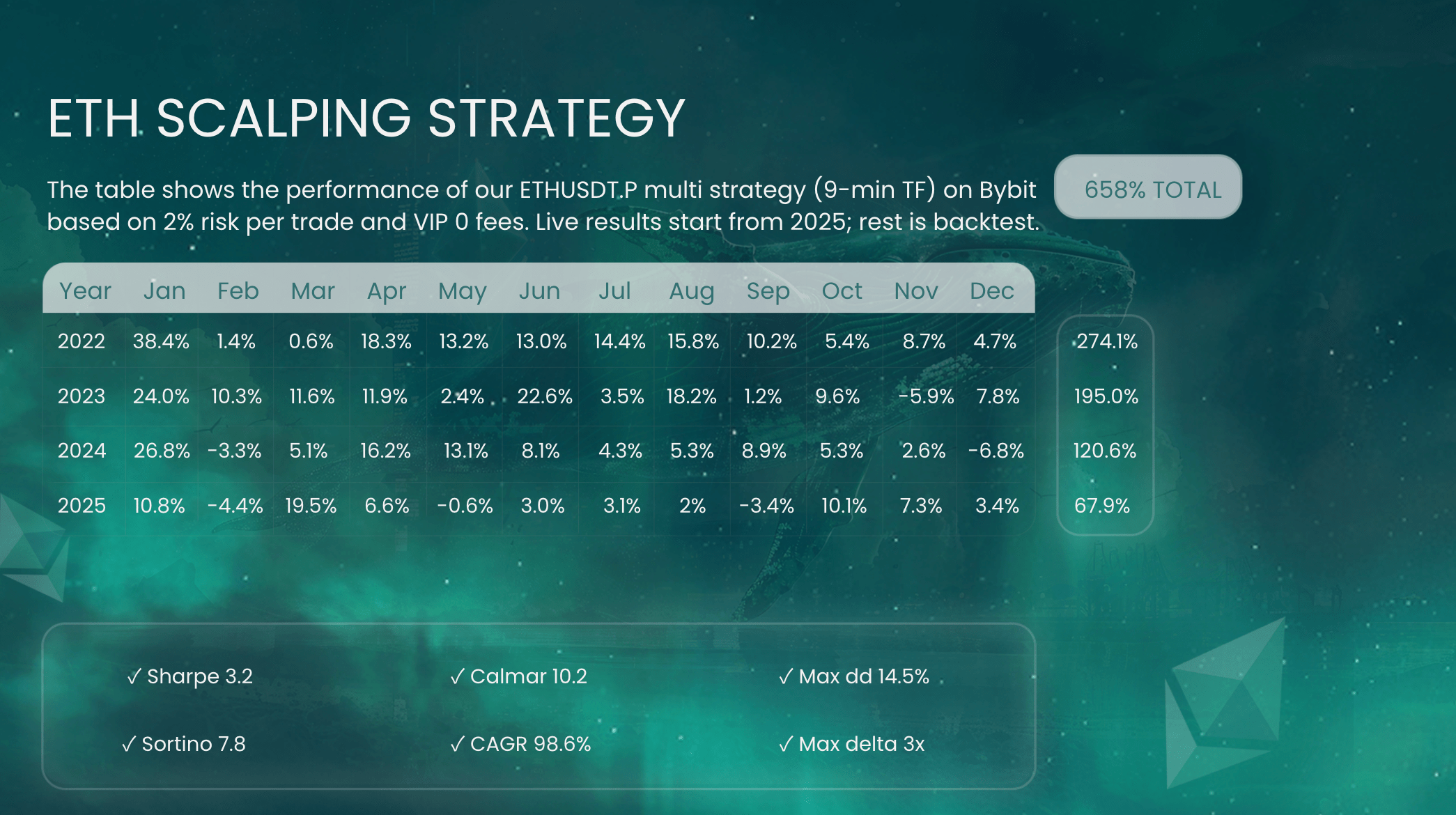

Our flagship ETH 9-minute perpetual multi-strategy delivered a +68% return at normal risk settings. These results were achieved in live trading and were driven by disciplined execution, strict risk control, and a focused approach to the markets we trade.

This performance was delivered alongside a significant increase in deployed trading capital, without compromising results. It confirms that our strategies and execution setup can scale while maintaining risk discipline and execution quality.

Taken together, these developments underline how much the crypto quant landscape has changed. In a market where conditions can shift quickly, strategy selection, risk management, and execution quality matter more than ever.

So what are the most important trends in the crypto quant world that allocators – and prospective allocators – should be paying attention to today? Why did Oxido Solutions perform strongly in 2025 while many competitors struggled or failed? And while we do not claim to predict the future, what could this mean for strategy selection and capital allocation going into 2026?

In the sections that follow, we share our perspective on these questions. This perspective is grounded in more than five years of live crypto quant trading, over two decades of trading and risk management experience, capital deployment at scale, and continuous interaction with institutional allocators.

2. THE CURRENT CRYPTO QUANT LANDSCAPE – STRUCTURAL SHIFTS

The crypto quant market is going through a structural transition rather than a temporary cycle. Several changes are happening at the same time: how capital enters the market, where alpha can still be found, and what it takes to stay competitive. The developments seen in 2025 reflect a market that is maturing, but also becoming more demanding for systematic strategies operating at scale.

Below, we outline the key structural trends shaping the crypto quant landscape today, with a focus on market structure, alpha dynamics, and execution requirements.

2.1 Accelerating Institutional Capital Inflows

Institutional participation in crypto quant strategies continued to grow throughout 2025. Importantly, this capital is no longer coming only from crypto-native investors. An increasing share now originates from traditional finance participants, including family offices, corporate treasuries, venture capital firms, and ultra-high-net-worth individuals with backgrounds in real estate, private equity, and operating businesses.

This shift is driven by a combination of changes in the broader investment environment and a clear change in the political and regulatory tone in the United States. Under the current U.S. administration, the stance toward digital assets has become more supportive compared to previous years. Crypto is no longer viewed primarily as a regulatory risk, but increasingly as a legitimate and strategic asset class. This change has reduced perceived regulatory uncertainty and strengthened institutional confidence.

At the same time, generating attractive risk-adjusted returns in traditional asset classes has become more difficult. Venture capital investments face longer holding periods and reduced liquidity. Real estate markets are under pressure from higher financing costs and regulation, which has weighed on rental yields. Public markets, meanwhile, have delivered less consistent return profiles.

Against this backdrop, allocators are increasingly turning to systematic trading strategies as an alternative way to deploy capital. Crypto quant strategies are attractive because they allow participation in crypto markets with defined risk limits, controlled exposure, and clear performance attribution. Unlike direct exposure to crypto assets, these strategies do not require investors to accept the full drawdown profiles commonly associated with spot holdings.

The ability to cap risk at the strategy level is a key factor. Many family offices and institutional investors are unwilling to tolerate drawdowns of 70–80% in assets such as BTC or ETH. Quant strategies offer a structure focused on controlled drawdowns, predefined risk budgets, and repeatable processes rather than directional conviction.

As institutional participation increases, capital has also become more selective. Allocators place greater emphasis on operational maturity, governance, reporting standards, and execution quality. As a result, capital is increasingly concentrated with providers that can demonstrate robust infrastructure, disciplined risk management, and the ability to scale without degrading performance.

2.2 Structural Alpha Compression in Bitcoin Strategies

As Bitcoin has become more institutionalized, its market structure has changed in noticeable ways. The growing presence of long-term holders, balance-sheet allocations, and ETF-related flows has changed liquidity dynamics and price behavior.

One clear consequence has been a shift toward more mean-reverting price action. Compared to earlier market phases, Bitcoin now shows less sustained directional follow-through and more frequent reversals around key liquidity areas. This has reduced the effectiveness of many trend-following and breakout strategies that depended on extended momentum.

As a result, many traditional Bitcoin-focused strategies have seen their edge decline. This has been most visible on classical intraday timeframes, roughly between 15 minutes and several hours. Increased participation and crowding on these horizons have reduced the consistency of historical inefficiencies. During 2025, a meaningful number of BTC-only quant strategies experienced sustained underperformance or were discontinued.

Alpha in Bitcoin has not disappeared, but it has become more concentrated and harder to extract. Performance now depends more heavily on regime awareness, execution quality, and sensitivity to changing liquidity conditions. Strategies that assume stable directional behavior or rely on static signals have struggled as price action has become more mean-reverting.

In practice, this has raised the technical and operational bar for Bitcoin trading strategies. Sustainable approaches require tighter risk controls, more adaptive behavior, and closer attention to market microstructure than in earlier phases of Bitcoin’s development.

2.3 Persistent Alpha in Ethereum and Liquid Altcoins

Ethereum remains at a different stage of institutional adoption than Bitcoin. Market participation is more fragmented, flow dynamics are more diverse, and volatility remains structurally present. As a result, ETH price action often shows cleaner directional moves, especially during volatility expansions.

Compared to Bitcoin, Ethereum shows less consistent mean-reversion on many intraday horizons. This creates a more favorable environment for short-term directional strategies that rely on momentum, breakouts, and microstructure-aware entries, provided execution quality is high.

In addition, selected liquid altcoins such as Solana (SOL) and Dogecoin (DOGE) continue to show recurring inefficiencies. These markets combine relatively deep liquidity with high turnover and clear short-term price movements. While volatility can be higher, price behavior is often cleaner, with clearer reactions to liquidity pockets and regime changes.

Importantly, the continued presence of alpha in these instruments is driven mainly by market structure rather than narrative or sentiment. Differences in participant behavior, liquidity provision, and order book dynamics continue to create short-term opportunities for systematic strategies.

For quantitative traders, this environment favors approaches that can adapt to changing volatility regimes while keeping execution costs and risk exposure under tight control.

2.4 Timeframe Migration and Strategy Crowding

Classical intraday timeframes – roughly between 15 minutes and several hours – have become increasingly crowded. As more capital deploys similar models on these horizons, statistical edge erodes and performance becomes more sensitive to execution quality, fees, and slippage.

In practice, this crowding has reduced the reliability of historical inefficiencies. Small differences in execution or market conditions can now have a large impact on realized results, making many strategies less stable than they appear in isolation.

As a result, alpha has gradually shifted toward shorter and non-standard timeframes. In these environments, market microstructure, liquidity distribution, and order book behavior play a larger role. Strategies operating here rely less on broad directional moves and more on precise timing and execution.

Operating effectively on these timeframes requires better infrastructure and tighter operational control. Latency, order placement logic, and real-time monitoring become core inputs rather than secondary considerations.

2.5 The Execution Arms Race

Improvements in technology have reshaped competition in crypto quant trading. As alpha has tightened and markets have become more sensitive to execution, execution quality has become a key factor in performance. Traders are no longer competing only on signal logic, but on how efficiently those signals are turned into trades.

Latency, order placement logic, fee structures, and exchange-specific behavior now play a larger role in determining realized performance. Small differences in entry timing, exit precision, and fill rates can clearly affect outcomes, especially for short-term strategies.

As a result, basic execution setups are no longer sufficient. Competitive strategies increasingly rely on advanced order execution systems that analyze order books in real time, improve queue positioning, and adjust behavior dynamically.

In markets where conditions can change quickly and inefficiencies disappear fast, execution quality is a core part of the edge and a key requirement for remaining competitive over time.

Collectively, these structural shifts have raised the operational and strategic bar for systematic trading in crypto. As markets mature and conditions change more frequently, weaknesses that were previously masked by favorable environments become visible more quickly.

Against this backdrop, it is useful to examine the most common structural failure modes observed in crypto quant trading – recurring patterns that emerge when strategies, risk structures, or infrastructure are not designed for changing conditions. These patterns have been observed by Oxido Solutions across multiple market regimes through live trading and the evaluation of a large number of quantitative strategies.

3. STRUCTURAL FAILURE MODES IN CRYPTO QUANT TRADING

As the crypto quant market has matured, a clear pattern has become visible. Many strategies that performed well during earlier market phases have struggled or failed once conditions changed. These outcomes are rarely caused by a single mistake. More often, they result from a combination of weaknesses that only become clear under stress.

Understanding these failure modes is important for allocators evaluating systematic strategies in a market where conditions can change quickly and operational demands have increased.

3.1 Execution as an Afterthought

Earlier in this report, we highlighted the growing importance of execution quality as markets have become more competitive and less forgiving. Seen in that light, it is not surprising that poor execution remains one of the most common structural weaknesses in crypto quant trading.

Many strategies are designed and evaluated primarily on signal logic, while execution is treated as a secondary implementation detail. In backtests, this often appears harmless. In live trading, however, this approach breaks down quickly.

Latency, slippage, fill rates, and fees have a direct and often decisive impact on results, particularly for short-term strategies. Generic execution setups, static order placement rules, or a lack of exchange-specific tuning frequently lead to a clear gap between backtested results and live performance. As markets become more crowded and margins tighten, these execution-related shortcomings tend to grow rather than diminish.

3.2 Fragile Risk Structures

Another frequent failure mode is weak risk control. Strategies may use too much leverage, have unclear drawdown limits, or allow risk to spread across positions or strategies.

When volatility rises or market conditions worsen, these weaknesses show up fast. Without system-enforced limits and clear separation of risk between strategies, losses can escalate and become difficult to recover from. In many cases, strategies fail not because the signals stop working, but because risk is allowed to increase without effective constraints.

3.3 Dependence on Narrow Market Assumptions

Many quant strategies rely on a single setup, timeframe, or type of market behavior. These strategies can work well when conditions match their assumptions, but they are fragile by design.

Markets change. Volatility moves up and down, liquidity shifts, and participant behavior evolves. Strategies built around narrow assumptions struggle once conditions move outside their comfort zone. Without diversification across setups or awareness of changing regimes, performance often breaks down.

3.4 Inability to Handle Sideways and Low-Quality Markets

Sideways and low-volatility markets remain a major challenge for systematic traders. Many strategies continue trading in these conditions even when expected returns are low.

To compensate, some increase trade frequency or loosen entry rules. Over time, this leads to overtrading, higher costs, and declining risk-adjusted results. Without effective filters for market quality, strategies are exposed to long periods of slow capital erosion rather than clear, controlled drawdowns.

3.5 Operational Fragility

Operational strength is often underestimated. Systems built from loosely connected components, shared infrastructure, or manual processes tend to fail when markets become stressed.

Exchange outages, data issues, and sudden volatility events expose weaknesses in monitoring and automation. In several cases, losses were caused not by strategy logic, but by delayed shutdowns, missed alerts, or systems that failed to respond in time.

3.6 Limited Experience Across Market Regimes

Many teams also lack experience across multiple market cycles. Strategies developed during favorable conditions are often unprepared for extended drawdowns, regime changes, or extreme market events.

Experience matters not only for strategy design, but also for setting risk limits, defining monitoring thresholds, and making operational decisions. Without it, systems tend to be tuned to recent conditions rather than built to survive a wider range of environments.

3.7 Common Strategy Types That Failed Under Changing Conditions

Across different market regimes, certain types of strategies have repeatedly struggled once conditions moved away from their original assumptions. These outcomes were usually not caused by poor coding, but by limitations in the strategy design itself.

One common example is DCA-based strategies (Dollar-Cost Averaging). These strategies add to positions as price moves against them, assuming that markets will eventually revert. This can work in range-bound markets, but it becomes risky during long directional moves without meaningful pullbacks. In such cases, exposure keeps growing while losses increase, often leading to drawdowns that are hard to recover from without strict risk limits.

Another group includes statistical arbitrage strategies in illiquid altcoins. These models look for temporary price differences between related instruments and expect them to converge. In practice, many depend on historical correlations that break down when liquidity drops. In thin markets, spreads can stay wide for long periods, while slippage further worsens results.

Pure directional strategies without protection against sideways markets also underperformed. During long range-bound phases, repeated false breakouts lead to many small losses. Over time, this “chopping” effect results in meaningful drawdowns even without large market moves.

Finally, some market-neutral strategies appeared stable on paper due to low volatility and small drawdowns. In reality, their low return profiles left little room for error. Technical issues, execution mistakes, or isolated loss events caused damage that was difficult to recover from given their limited profit potential.

Taken together, these examples point to the same conclusion. Strategies built around narrow assumptions or static market behavior tend to fail when conditions change. Long-term robustness requires more than signal logic alone.

3.8 Bridging Perspective

These failure modes reflect the current reality of the crypto quant market. They show why strategy ideas by themselves are not enough, and why execution quality, risk control, adaptability, senior experience, and operational strength have become essential.

Together, these observations set the context for evaluating trading philosophies and system design choices. The next chapter outlines the principles that guide how we address these challenges.

4. OUR PHILOSOPHY

Oxido Solutions’ trading philosophy is shaped by long-term experience across multiple market cycles, asset classes, and trading styles. While tools, venues, and technology continue to change, our core principles have remained consistent since the firm was founded.

These principles define how we think about markets, risk, and decision-making. They apply across strategies, assets, and timeframes, and form the foundation of everything we build and deploy.

So what guides our approach in practice? Below, we outline the seven core principles that shape how we design strategies, manage risk, and participate in markets.

4.1 Markets Are Regime-Driven, Not Static

Financial markets do not behave the same way all the time. Markets move between trending phases, consolidation, volatility expansion, and compression. While specific triggers change, certain structural elements – liquidity, volatility, and price movement – are always present in some form.

We do not attempt to predict market regimes. Instead, we focus on effective participation across changing conditions through a hedged, multi-strategy setup. We accept that consistent forecasting is not possible.

Strategies are designed to adjust their behavior as market quality changes, rather than forcing participation based on fixed assumptions.

4.2 Alpha Exists, but Must Be Actively Sought

We believe that alpha continues to exist in financial markets, but it is not stable or evenly distributed. It shifts across assets, timeframes, and regimes as participation, liquidity, and behavior change.

Rather than relying on a single setup or market condition, our approach is to look for alpha where structural inefficiencies still exist. This requires flexibility, selective participation, and the discipline to step aside when conditions are unfavorable.

4.3 Reaction Over Prediction

Markets cannot be controlled or forecast with precision, especially over short time horizons. Trying to predict turning points or regime changes often introduces bias and emotional pressure.

Our philosophy prioritizes reacting quickly and accurately to observable market behavior. Capturing a consistent portion of a move is more reliable than attempting to predict its full extent. This preference for reaction over prediction is central to how our strategies are designed and evaluated.

4.4 Automation as a Discipline Tool

Manual trading introduces unavoidable sources of error, including emotional bias, fatigue, and inconsistency. While discretionary insight can be useful, executing systematic strategies manually at scale is inherently difficult.

For this reason, our trading approach is fully automated. Automation enforces discipline, ensures consistent execution, and allows strategies to operate continuously without emotional interference. Human oversight remains important, but decision-making itself is handled by predefined logic.

4.5 Risk Management as a Primary Objective

Risk management is not treated as something applied after strategy design. It is a primary objective from the start. Preserving capital and controlling drawdowns take priority over maximizing short-term returns.

This philosophy favors controlled exposure, diversification across strategies and timeframes, and the acceptance that not trading is sometimes the best decision. Avoiding large losses is essential for long-term compounding.

4.6 Diversification as a Structural Principle

Diversification is applied not only across markets, but also within strategies and timeframes. Relying on a single setup or market condition creates fragility.

Our approach emphasizes diversification at multiple levels, as long as markets meet basic requirements for liquidity, transparency, and execution reliability. This helps strategies remain reliable across changing conditions without depending on any single instrument or regime.

4.7 Continuous Improvement Without Over-Optimization

Markets evolve, and strategies must evolve with them. At the same time, adding excessive complexity increases fragility and reduces reliability.

We treat backtesting and live trading as complementary. Backtesting is used to test assumptions on historical market data, understand how a strategy behaves across different market environments, and define the conditions under which it is expected to operate. It helps establish boundaries rather than optimize outcomes.

Live trading then provides the final validation. It shows how strategies behave under real conditions, including execution delays, changing liquidity, fees, and sudden shifts in market behavior that cannot be fully captured in simulations.

Improvements are introduced gradually. Changes are first evaluated in backtests and then observed in live trading under controlled exposure. They are assessed based on consistency and stability, not on isolated improvements in historical performance.

This disciplined process is designed to avoid curve-fitting and over-optimization.

Curve-fitting occurs when a strategy is tuned too closely to historical data. Parameters are adjusted until past results look strong, but the strategy ends up learning noise rather than underlying market structure. Such strategies often perform well in backtests but fail once conditions change.

Over-optimization refers to the broader process that leads to curve-fitting. It involves repeatedly adjusting parameters or rules to improve historical results without improving real-world behavior. This typically increases complexity while reducing robustness.

Our approach avoids these pitfalls by limiting parameter complexity, favoring structural logic over fine-tuned thresholds, and requiring stable behavior across multiple market regimes. Changes must prove themselves in live trading before becoming part of the system.

This allows strategies to adapt over time while maintaining reliability, rather than chasing short-term performance at the expense of long-term stability.

5. TECHNOLOGY

The trading philosophy described in the previous chapter only matters if it works in live markets. In systematic trading, ideas and implementation cannot be separated. Strategy logic, execution behavior, risk controls, and system stability must operate together as one system.

Oxido Solutions’ technology stack was built to apply this philosophy in practice. Rather than relying on manual decisions or discretionary intervention, participation, risk limits, and adaptability are built directly into the system itself. Design choices at every level reflect the principles described earlier and are intended to function consistently as market conditions change.

Over several years of live trading, the platform has been shaped by exposure to different volatility regimes, liquidity environments, and stress events. The result is an integrated trading system that supports multiple strategies, execution-sensitive trading, and controlled risk management at scale.

This chapter describes the core components of the Oxido Solutions technology stack and how they work together to translate trading philosophy into consistent behavior in live markets.

5.1 Trading System Architecture

Oxido Solutions’ trading system architecture has changed significantly over time. In earlier phases, key components — signal generation, order execution, and continuous monitoring — ran as separate applications across different hosting environments. While this setup worked, it introduced unnecessary complexity, internal delays, and operational dependencies.

Based on live trading experience, the system was consolidated into a single application framework. Strategy logic, signal generation, execution control, risk management, and monitoring now operate within one integrated system. This reduces internal delays, improves data consistency, and allows tighter coordination between decision-making and execution.

As a result, the time between signal generation and order placement at the exchange has been reduced to approximately 0.5 milliseconds. For short-term and execution-sensitive strategies, this improves entry accuracy, exit timing, and fill quality.

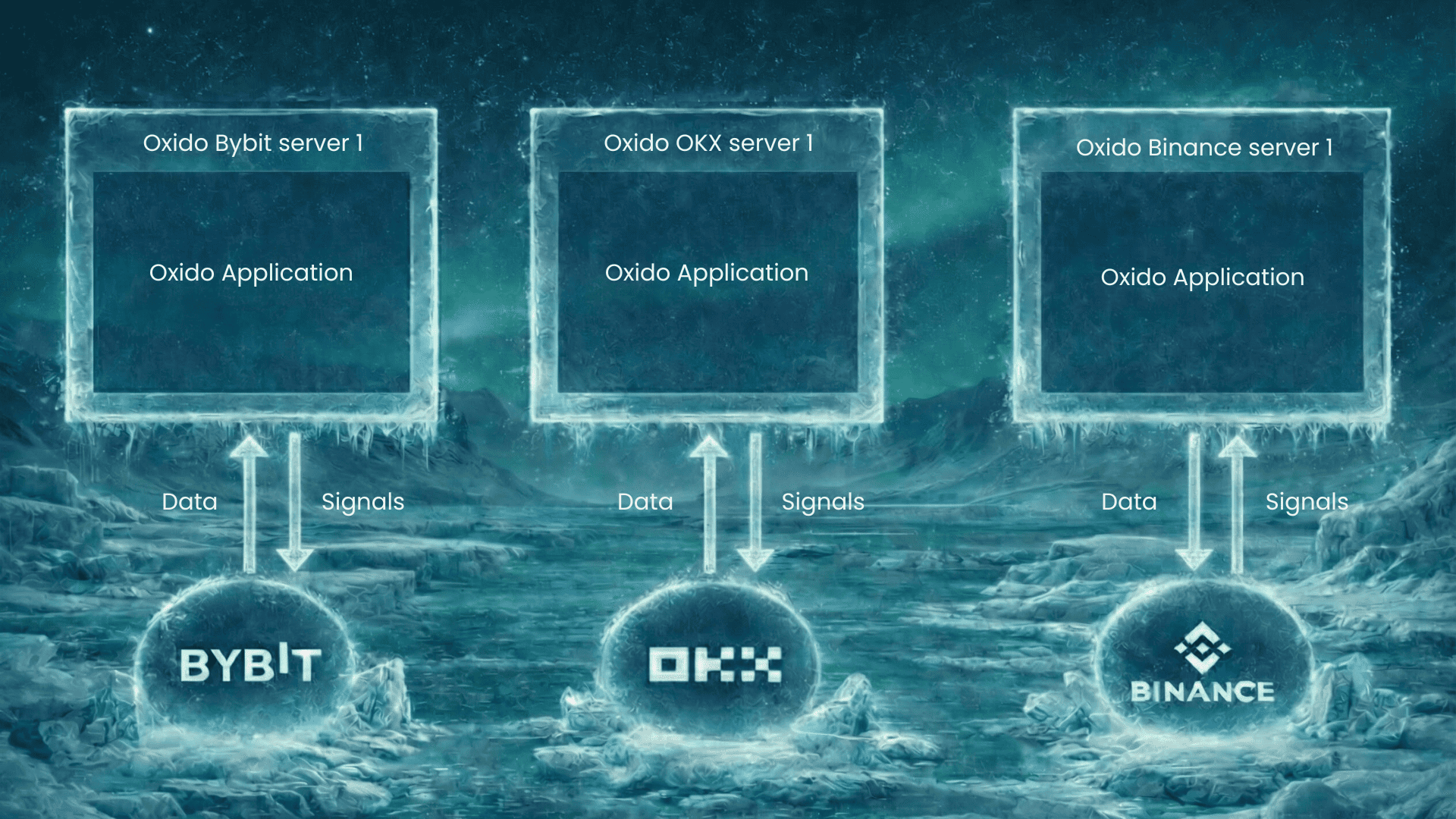

At the deployment level, the system remains deliberately distributed. Each exchange runs on its own dedicated application instance, hosted as close as possible to the exchange’s matching engine. For example, Bybit and OKX instances are hosted in Singapore, while Binance instances run in Japan. This setup reduces network latency and avoids unnecessary dependencies between venues.

Each application instance is limited to a maximum of twelve sub-accounts per server. This avoids performance bottlenecks, limits the impact of failures, and ensures stable behavior under load. As deployed capital or the number of strategies increases, additional servers are added per exchange rather than expanding individual instances beyond this limit.

At the strategy layer, multiple independent strategy components run in parallel. Each responds differently to changes in volatility, liquidity, and price behavior. This reduces reliance on any single setup and creates diversification at the strategy level.

Within the unified system, responsibilities are clearly separated. Signal logic, execution logic, risk controls, position sizing, and monitoring are implemented as distinct internal layers. This allows components to be adjusted over time while remaining tightly coordinated.

System stability is a primary design objective. The platform is built to handle regime shifts, data issues, and temporary market disruptions. When conditions worsen, strategies reduce exposure or stop trading rather than forcing activity.

5.2 Market Data & Data Integrity

All trading decisions within the Oxido Solutions system are based on real-time and historical market data sourced directly from the exchanges on which trading takes place. This includes trade prices, order book data, volumes, and funding rates.

By sourcing data directly from exchanges rather than relying on third-party aggregators, the system minimizes latency and avoids normalization delays. This is particularly important for short-term and execution-sensitive strategies, where small discrepancies in price or order book data can materially affect execution outcomes.

Incoming data streams are continuously validated for consistency, completeness, and abnormal behavior. The system monitors for issues such as feed interruptions, delayed updates, and unusual price deviations. When data quality falls below predefined thresholds, trading activity is automatically reduced or halted.

This ensures that strategy logic, execution decisions, and risk controls always operate on reliable inputs. Data integrity is treated as a prerequisite for participation, not as a background assumption.

5.3 Directional Breakout Scalping Framework

All strategies deployed on the Oxido Solutions platform follow a directional breakout scalping framework. While individual variants differ by instrument, timeframe, or sensitivity, they share the same underlying approach to market participation.

The goal is to capture short-term directional price movement that follows volatility expansion, liquidity shifts, or the resolution of price compression. Strategies do not attempt to forecast long-term trends or turning points. Instead, they react to observable changes in price behavior and participate selectively when momentum emerges.

The system uses a multi-strategy setup with several directional models running at the same time. Some components are designed for fast-moving, high-volatility conditions, while others perform better during slower or range-bound phases. This creates internal diversification and natural hedging effects.

Breakout logic operates at a short-term structural level. Trade initiation is based on changes in range behavior and price structure rather than fixed price levels. Holding periods are intentionally short, focusing on capturing defined parts of a move rather than extended trends.

This framework is closely linked to exposure controls and risk limits. When market behavior does not support clean directional movement, activity is reduced or stopped.

5.4 Execution & Order Management

Execution is a core part of the trading system and directly linked to the integrated architecture described above. Because strategy logic and execution control run within the same application, decisions can be acted on with minimal delay.

Orders are handled by a proprietary, AI-driven execution engine built for short-term strategies. The system continuously evaluates order book conditions, liquidity distribution, and spread behavior to determine how orders should be placed.

A key principle of the execution layer is limit-first order placement. When conditions allow, passive orders are preferred to reduce trading costs and improve effective entry and exit prices. Order behavior adjusts dynamically based on volatility, queue position, and fill probability.

Execution logic accounts for venue-specific characteristics. Differences in order book structure, matching behavior, and fee schedules are handled explicitly rather than abstracted away. This improves fill quality and consistency across exchanges.

The execution engine manages the full order lifecycle, including placement, modification, cancellation, and fallback behavior, while staying within all active risk limits.

5.5 Risk Management Layer

Risk management is built into the core of the system. All strategies operate within a centralized risk framework that applies predefined limits continuously and automatically.

Risk parameters include exposure limits, leverage caps, drawdown thresholds, and isolated margin constraints. These limits operate independently of strategy logic or execution behavior.

Risk is controlled at the strategy level through margin isolation. Losses in one strategy or instrument cannot affect others. This allows downside exposure to be managed precisely and in line with institutional requirements.

Additional protections respond to unusual market behavior such as extreme volatility spikes or data irregularities. In such situations, preserving capital takes priority over continued trading.

5.6 Market Conditions & Sideways Filters

Market conditions vary widely. Periods of low volatility, compressed ranges, or unstable price behavior often produce weaker trade opportunities.

The system evaluates market conditions using volatility, range behavior, liquidity characteristics, and price structure. This allows it to distinguish between environments that support active trading and those that do not.

A key component is the sideways, or “chop,” filter. During prolonged range-bound or weak conditions, exposure is reduced or new entries are avoided. Adjustments are applied gradually rather than through simple on/off switches.

These assessments are closely linked to risk management and strategy logic so that exposure adjusts smoothly as conditions change.

5.7 Position Sizing & Trade Management

Position sizing and trade management are dynamic. Exposure adjusts continuously based on market behavior, volatility, and active risk limits.

Position sizes scale automatically within predefined risk budgets. As conditions worsen, exposure is reduced. When conditions improve, exposure can increase within strict boundaries.

Each trade has a predefined invalidation level. Stop-loss logic is applied consistently and is not widened to offset unfavorable price movement. Trade management focuses on capturing repeatable portions of directional movement rather than optimizing individual exits.

5.8 Monitoring, Watchdogs & Human Oversight

Although the system is fully automated, continuous monitoring remains essential. A 24/7 monitoring layer tracks system health, data quality, execution status, connectivity, and risk compliance.

Independent watchdog processes detect issues such as unusual volatility, liquidity gaps, data inconsistencies, or execution problems. When triggered, the system can reduce exposure or stop trading automatically.

Human oversight complements automation. The team reviews alerts, investigates issues, and monitors external factors such as exchange outages or infrastructure problems. Human involvement does not override strategy logic but ensures operational stability.

5.9 Scalability & Ongoing Development

Scalability and development are treated as core design requirements. The system is built to support additional capital, strategy variants, and markets without compromising execution quality or risk discipline.

Capacity limits are clearly defined to prevent performance issues. Development is driven by live trading feedback rather than theoretical optimization. Changes are introduced step by step, tested cautiously, and deployed gradually.

This approach allows the platform to adapt over time while remaining stable and reliable.

6. OPERATING OUTLOOK FOR 2026

Looking ahead to 2026, Oxido Solutions’ focus is on continuity, stability, and disciplined expansion rather than structural change. The objective is not to reinvent the trading system, but to continue deploying what has already proven effective across multiple market regimes.

Oxido Solutions will not add new exchanges in the near term. The current venues provide sufficient liquidity, infrastructure maturity, and operational familiarity. By limiting the number of trading venues, operational complexity remains manageable and execution quality can be maintained as capital scales.

Growth in 2026 is therefore expected to come primarily from the expansion of strategy variants built on the existing directional breakout scalping framework. Rather than introducing new strategy concepts, Oxido Solutions continues to deploy calibrated variations of a system that is already live and well understood.

In December 2025, four new strategy variants were launched:

- ETH 6-minute Range Maker

- ETH 8-minute Range Maker

- SOL 9-minute Range Maker

- DOGE 9-minute Range Maker

These strategies run on the same core technology stack, share the same execution and risk framework, and differ only by instrument, timeframe, and range definition. Their deployment confirmed that additional variants can be introduced without adding operational complexity or altering risk behavior.

For 2026, the plan is to extend this approach further, with an expected rollout of approximately ten strategy variants. Each variant will be introduced gradually, with clearly defined capacity limits and independent risk constraints. Capacity will remain capped where necessary to preserve execution quality and risk characteristics.

This approach allows Oxido Solutions to scale in a controlled and repeatable way. By expanding breadth within a proven framework, rather than pursuing new markets or untested concepts, the focus remains on consistency, transparency, and long-term operational stability

7. KEY TAKEAWAYS FOR ALLOCATORS

The crypto quant market has entered a more mature and demanding phase. Changes in market behavior, increased competition, and higher operational requirements mean that historical performance alone is not sufficient to evaluate strategy quality. For allocators, due diligence must extend beyond returns to include system design, execution capability, and risk discipline.

Based on the analysis in this report, several key takeaways stand out.

7.1 Strategy Logic Alone Is Not Enough

Many strategies fail not because the core idea is flawed, but because execution, risk management, or operational controls are insufficient. In short-term trading environments, even small weaknesses in execution or risk containment can erode theoretical edge.

Allocators should assess strategies as complete systems, not as isolated signal models.

7.2 Execution Quality Directly Affects Outcomes

Latency, order placement logic, fee efficiency, and venue-specific behavior all influence realized performance. In scalping and other short-term strategies, execution is not a secondary detail but a central part of the outcome.

Understanding how a strategy is executed is as important as understanding what it trades.

7.3 Risk Must Be Built Into the System

Effective risk management cannot rely on discretion or post-trade review. Clear limits, isolation, and real-time controls are essential to prevent losses from escalating when conditions change.

Allocators should prioritize strategies where risk constraints are embedded directly into the system rather than applied externally.

7.4 Adaptability Matters More Than Precision

Markets move between different volatility regimes, liquidity environments, and structural behaviors. Strategies built on narrow assumptions or static conditions tend to weaken over time.

Robust systems focus on participating across changing conditions rather than on precise forecasting, supported by dynamic exposure control and regime awareness.

7.5 Operational Resilience Is Often Overlooked

Infrastructure design, monitoring, and fail-safe mechanisms play a critical role during periods of stress. Many losses in systematic trading are caused by operational breakdowns rather than by flawed strategy logic.

Allocators should examine how systems behave during abnormal market events, not only during stable conditions.

7.6 Scalability Requires Discipline

Growth in capital or strategy count must be managed carefully. Scaling should not come at the expense of execution quality, risk characteristics, or system stability.

Strategies that define clear capacity limits and scale by adding parallel instances tend to remain more stable than those that pursue unrestricted growth.

7.7 Transparency and Process Matter

Clear reporting, well-defined processes, and consistent system behavior support effective allocator oversight and long-term alignment. Sustainable relationships depend on transparency as much as on performance.

7.8 Closing Perspective

For allocators, the key question is not whether a strategy can perform in favorable conditions, but whether it can remain controlled and operational as markets evolve.

The analysis in this report highlights the importance of evaluating crypto quant strategies through a structural lens – focusing on system design, execution capability, risk enforcement, and operational maturity rather than isolated performance metrics.

Disclaimer

This document has been prepared by Oxido Solutions for informational purposes only and does not constitute an offer, solicitation, recommendation, or invitation to buy or sell any securities, financial instruments, or investment products, nor to participate in any trading strategy or managed account.

The information contained herein is based on sources believed to be reliable and reflects the views and analyses of Oxido Solutions as of the date of publication. However, no representation or warranty, express or implied, is made as to the accuracy, completeness, or timeliness of the information. All statements, opinions, and estimates are subject to change without notice.

Any performance figures referenced in this document relate to historical or live trading results and are provided for illustrative purposes only. Past performance is not indicative of future results. Trading in digital assets and derivatives, including perpetual futures, involves substantial risk and may result in partial or total loss of capital. There can be no assurance that any strategy will achieve its stated objectives or generate positive returns.

This document does not take into account the specific investment objectives, financial situation, or particular needs of any recipient. Prospective allocators should conduct their own independent analysis and due diligence, and consult with their own legal, tax, and financial advisors before making any investment or allocation decision.

Oxido Solutions does not provide investment advice, legal advice, or tax advice. Participation in any strategy or structure described herein is subject to applicable laws, regulations, and contractual documentation, which shall prevail in the event of any inconsistency with this document.

Unauthorized distribution, reproduction, or use of this document, in whole or in part, is strictly prohibited without the prior written consent of Oxido Solutions